The History and Chronology of Stocks, Bonds, and Certificates

1. Early History

Ancient Civilizations:

- Mesopotamia and Ancient Greece: Early forms of debt instruments and trade records.

- Rome: Developed a sophisticated system of trade and credit, including debt contracts.

Middle Ages:

- 11th-15th Centuries: Italian city-states like Venice and Genoa issued bonds to finance wars and public projects.

- 12th Century: Development of early banking and credit systems in

Europe.

From ancient trade practices to modern digital securities, financial instruments have consistently shaped global economies.

2. The Birth of Modern Financial Instruments

a. 16th-17th Centuries:

- The Amsterdam Stock Exchange (1602): Established by the Dutch East India Company, this was the first official stock exchange where company shares could be bought and sold.

- Joint-Stock Companies: Enabled investors to buy shares in a company, distributing risk and profit.

b. 18th Century:

- Bank of England (1694): Issued bonds to finance government debt.

- South Sea Bubble (1720): One of the earliest stock market bubbles and crashes.

The Amsterdam Stock Exchange, established in 1602, was the world’s first official stock exchange.

3. Developments in the 19th Century

a. Industrial Revolution:

- Railway Bonds and Shares: Financing infrastructure projects through bonds and stocks became common.

- New York Stock Exchange (NYSE) (1817): Founded and became a central hub for trading securities in the United States.

b. Global Expansion:

- London Stock Exchange (1801): Became prominent, facilitating international trade and investment.

- Paris Bourse: An important European stock exchange, contributing to the global financial system.

The integration of technology in finance is revolutionizing markets with innovations like blockchain and algorithmic trading.

4. 20th Century

a. Early 20th Century:

- Panic of 1907: Led to the creation of the Federal Reserve System in 1913 to stabilize the economy.

- Great Depression (1929): A major global economic downturn impacting stock markets and leading to new regulations.

b. Post-WWII:

- Bretton Woods System (1944): Established international monetary policies and the International Monetary Fund (IMF).

- Growth of Mutual Funds (1950s-1960s): Provided individual investors with access to diversified portfolios.

c. Late 20th Century:

- Black Monday (1987): A major stock market crash, leading to the development of modern financial regulations.

- Rise of Technology Stocks (1990s): The dot-com boom saw rapid growth and subsequent bust of tech companies.

Sustainable investing, with a focus on ESG criteria, is redefining the future of financial markets.

5. 21st Century Developments

a. Early 2000s:

- Dot-Com Bubble Burst (2000): Significant impact on technology stocks.

- Global Financial Crisis (2008): Severe worldwide economic crisis leading to the collapse of major financial institutions.

b. Regulatory Changes:

- Dodd-Frank Act (2010): Introduced to prevent another financial crisis by increasing transparency and accountability in the financial system.

c. Technological Innovations:

- Algorithmic Trading and High-Frequency Trading: Significantly altered stock market dynamics.

- Cryptocurrencies and Blockchain (2010s): Emergence of digital assets and new forms of certificates.

Key Concepts and Instruments

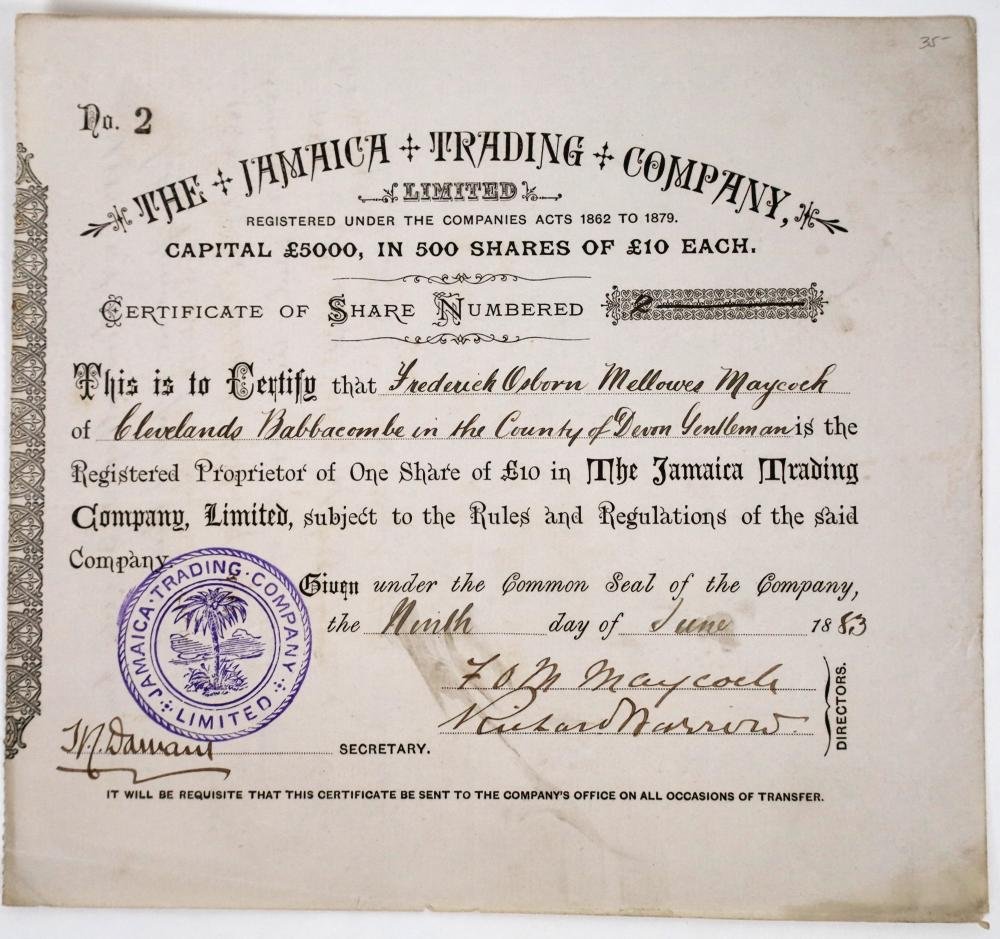

1. Stocks:

- Definition: Shares representing ownership in a company.

- Types: Common stock and preferred stock.

- Market: Traded on stock exchanges like NYSE, NASDAQ, and London Stock Exchange.

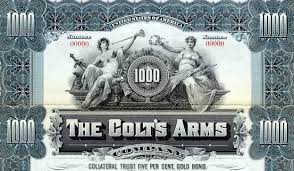

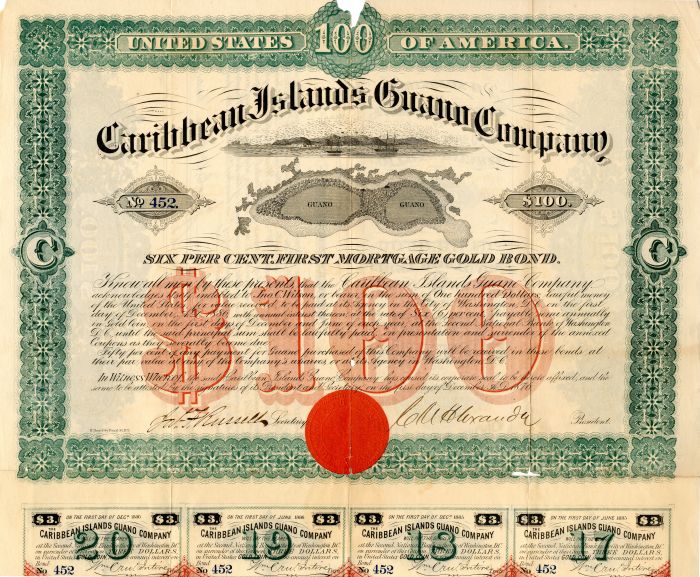

2. Bonds:

- Definition: Debt securities issued by governments or corporations to raise capital.

- Types: Government bonds, corporate bonds, municipal bonds.

- Market: Traded on bond markets; includes primary and secondary markets.

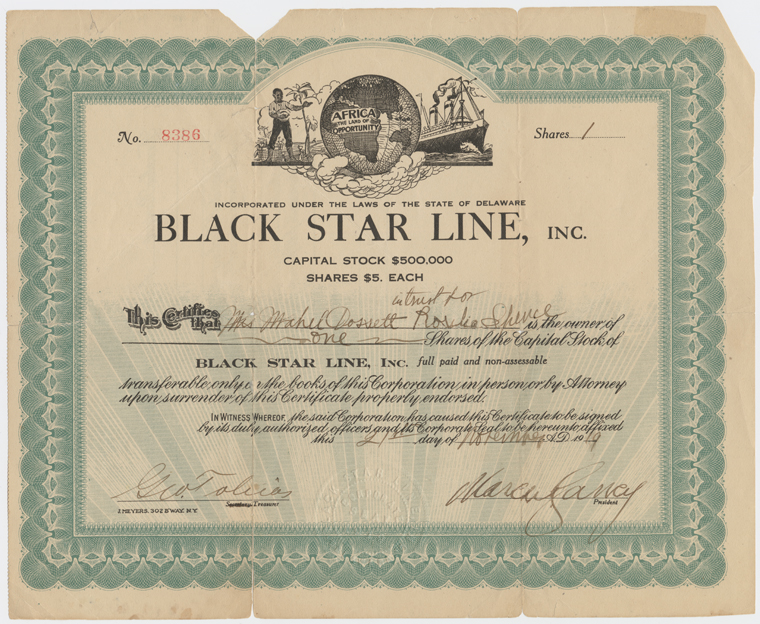

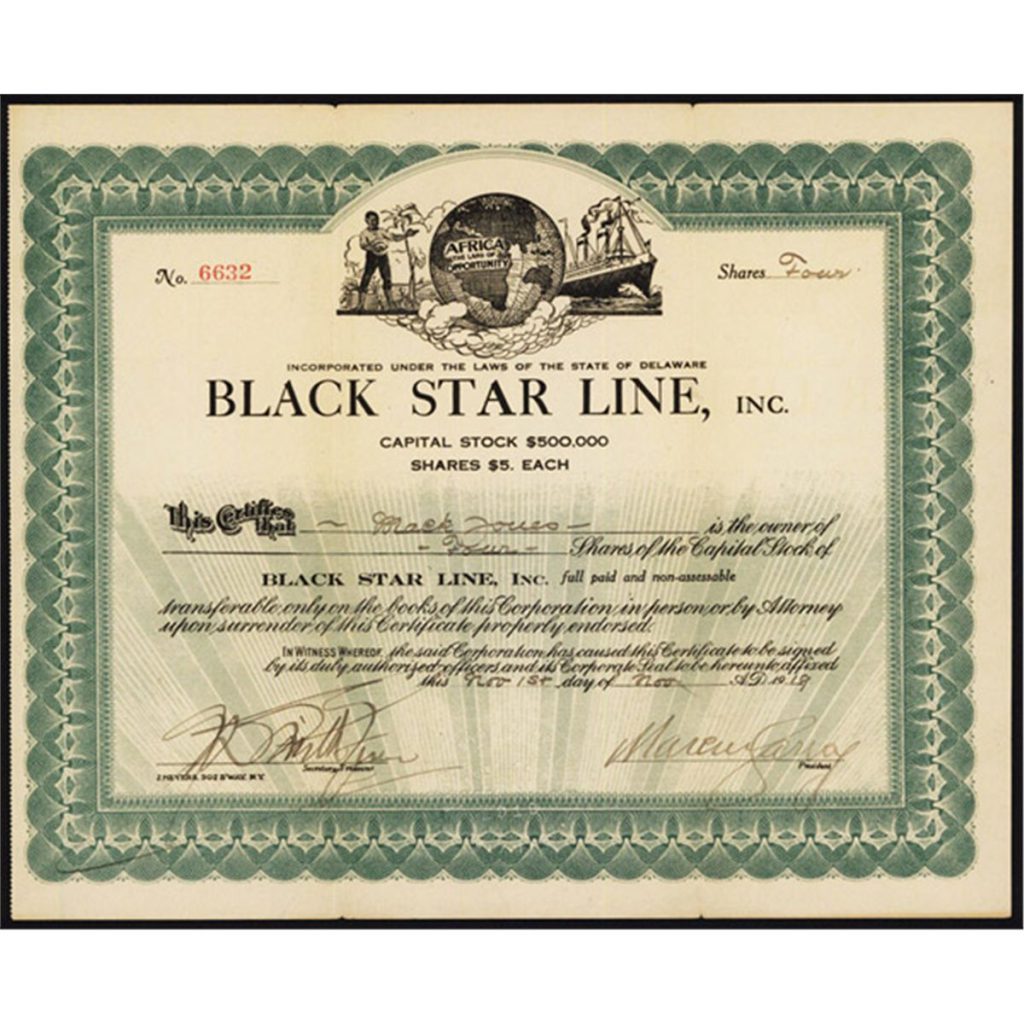

3. Certificates:

- Definition: Documents representing ownership or rights in a financial asset.

- Types: Stock certificates, bond certificates, deposit certificates.

- Digital Transition: Moving towards electronic records and dematerialized securities.

Modern Trends and Future Directions

As financial instruments like stocks, bonds, and certificates have evolved over time, they have consistently reflected broader economic, technological, and regulatory changes. Today, trends such as sustainable investing—with a focus on Environmental, Social, and Governance (ESG) criteria—Fintech, Decentralized Finance (DeFi), and globalization continue to shape the future of financial markets. The integration of technology in financial services, including robo-advisors and blockchain, as well as the increasing interconnectedness of global markets, will likely influence the trading and management of these instruments in the years to come. From ancient trade practices to modern digital securities, the evolution of these financial instruments has played a crucial role in shaping global economies and will continue to be pivotal as the financial landscape advances. to evolve with technological advancements and shifting investor priorities.

1. tba

The evolution of stocks, bonds, and certificates reflects broader economic, technological, and regulatory changes. From ancient trade practices to modern digital securities, these financial instruments have been pivotal in shaping global economies and will continue to evolve with technological advancements and shifting investor priorities.

2. asdfasdfadf